Your Home Equity May Surprise You

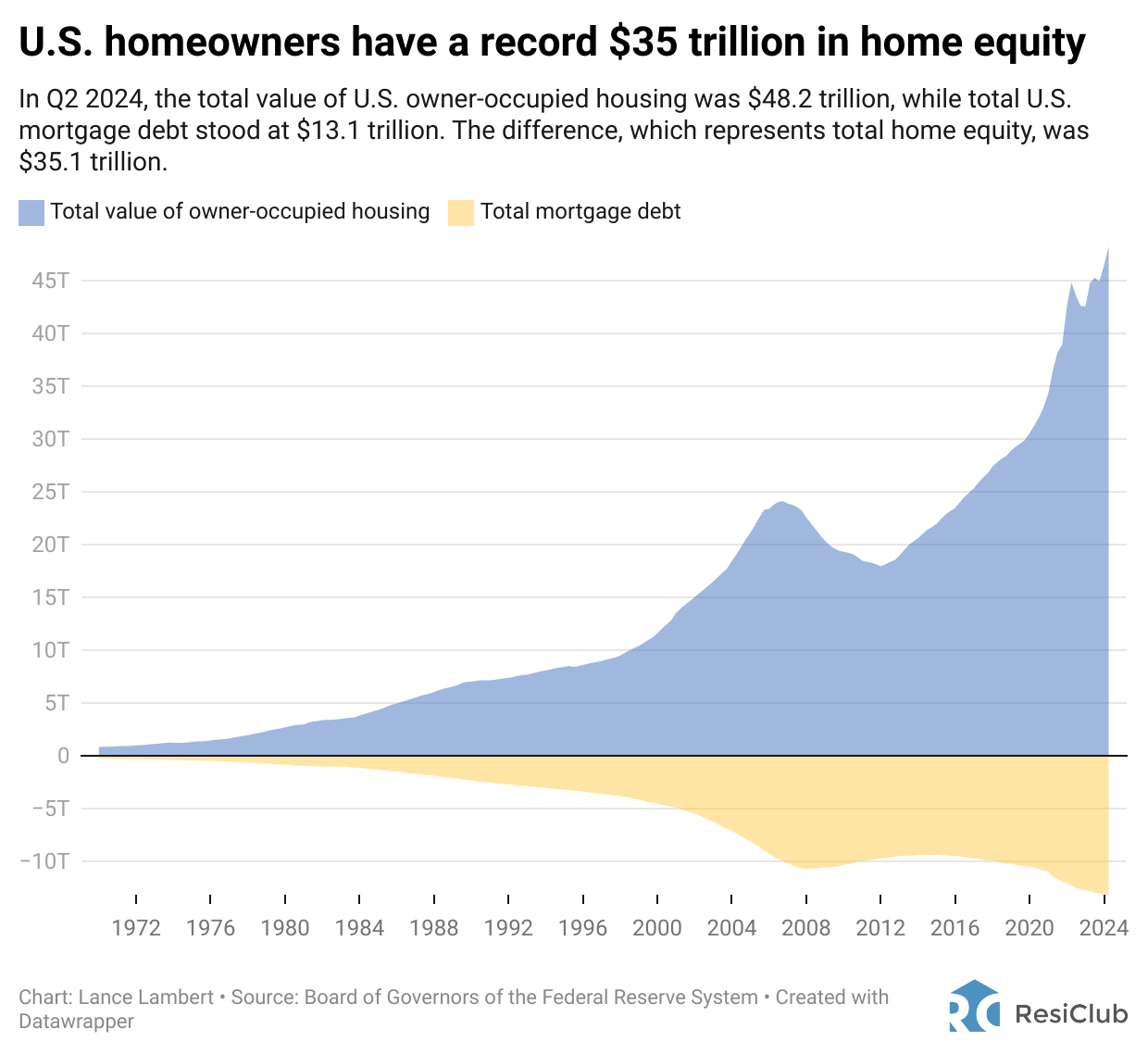

The Federal Reserve just released data for the second quarter in 2024, showing homeowners across the nation are collectively holding a staggering $35.1 trillion in home equity. This represents an incredible 85% increase from just five years ago, when the total stood at $19 trillion in Q2 - 2019.

Increased Financial Security

With the recent surge in home equity, you might find yourself with a significant financial buffer. Even if moving isn’t on your immediate horizon, this equity can be a valuable resource. A few ways to leverage your home equity include:

- Home improvements

- Investing in additional properties

- Funding education

- Emergency reserves

- Planning for retirement

Exciting Opportunities for Sellers

If you've been thinking about upgrading to a larger home or relocating to a more desirable area, your increased equity could turn that dream into a reality, even in the face of higher interest rates. Depending on your circumstances, you might have enough equity to make a substantial downpayment on your next home without touching personal funds or perhaps even buy your next property outright. In today’s market, your equity is a powerful asset to counterbalance the challenges of housing affordability.

First-Time Homebuyers

Picture a scenario where you’re no longer racing to keep up with rising home prices. Instead, your savings grow alongside the housing market through building home equity. Even if you don’t plan on staying in your home forever, buying your first property is one of the best ways to protect yourself from the mounting affordability issues in the housing market and set yourself up for long-term success. Here’s why:

- Equity Growth: As home values rise, you’ll start accumulating equity as soon as you purchase your home.

- Structured Savings: Monthly mortgage payments act as a form of disciplined savings, helping you build wealth as you pay down the loan.

- Tax Benefits: Owning a home often comes with potential tax advantages.

- Stability: Homeownership offers security and control over your living situation.

Real estate has long been one of the most dependable ways to create long-term wealth, and this recent rise in home equity only strengthens that idea.

In Conclusion

Whether you’re a current homeowner ready to take advantage of your equity, a potential seller weighing your options, or a first-time buyer stepping into the market, now is a great time to explore the opportunities available in real estate.

Feel free to get in touch to discuss how these market trends might benefit your unique situation. I’m here to guide you through this dynamic landscape and help you make the most of your real estate investments.

Here’s to your continued success and financial prosperity!

Always here to assist,

Categories

Recent Posts