30 Years of Home Prices: A Journey Through Booms, Busts, and Beyond

The Evolution of Home Prices Over the Last 30 Years

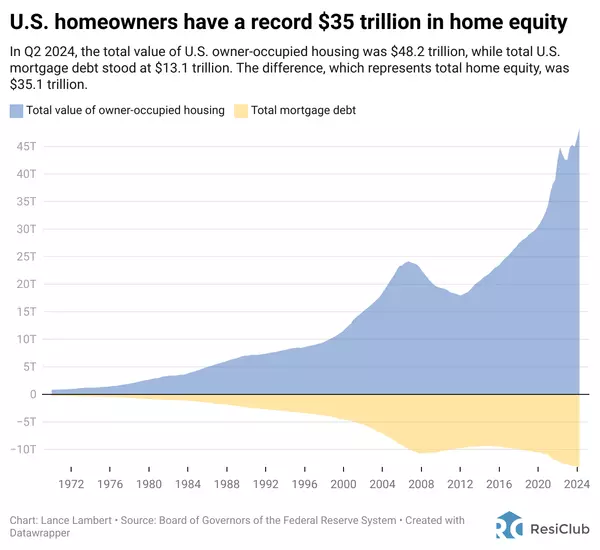

Over the past 30 years, the U.S. housing market has seen tremendous fluctuations in home prices, shaped by a combination of economic cycles, policy changes, demographic shifts, and technological advancements. From the housing boom of the early 2000s to the dramatic downturn during the Great Recession and the recent post-pandemic surge, the market has experienced notable highs and lows. Here’s a look at the key trends and factors that have influenced home prices over the past three decades.

1. 1990s: Steady Growth and Low Inflation

In the 1990s, the U.S. housing market was characterized by steady price appreciation. The economy was robust, inflation was relatively low, and mortgage rates averaged around 7-8%. The 1990s were a period of stable growth, and home prices gradually increased at a rate of about 4-5% annually.

The internet's expansion also began to influence real estate, with the rise of online listings and tools to make home buying more transparent and accessible. However, price increases were modest compared to the housing boom that was about to follow.

2. Early 2000s: The Housing Boom

The early 2000s witnessed one of the most significant home price booms in U.S. history. A combination of low interest rates, relaxed lending standards, and increased demand for homeownership spurred a massive increase in housing prices. Between 2000 and 2006, home prices rose at unprecedented rates, with some markets seeing double-digit annual increases.

During this time, speculative buying also played a role, as investors sought to capitalize on rising prices. The demand for homes and an abundance of credit led to an overheated market. By 2006, the median home price in the U.S. had surged by nearly 50% compared to the beginning of the decade.

3. 2008-2012: The Great Recession and Housing Crash

The housing boom ended in a dramatic crash that triggered the Great Recession in 2008. The collapse was driven by the bursting of the housing bubble, fueled by risky mortgage lending practices and subprime loans. As home prices began to decline, millions of Americans found themselves "underwater," owing more on their mortgages than their homes were worth.

Between 2008 and 2012, home prices dropped sharply, with some markets experiencing price declines of over 30%. Foreclosures skyrocketed, and the housing market was in freefall. The financial crisis also led to a tightening of credit, making it difficult for many to buy homes, which further depressed prices.

4. 2013-2019: Recovery and Stabilization

After the downturn, home prices began to recover slowly from 2013 onward. The recovery was uneven, with some regions rebounding faster than others. Metropolitan areas like New York, San Francisco, and Boston saw strong gains due to economic growth and increased demand for housing.

Low mortgage rates and a growing economy contributed to the steady rise in home prices. By the end of the decade, home prices had fully recovered in most regions, surpassing their pre-recession levels. Millennials entering the housing market in large numbers also played a role in driving demand.

5. 2020-2023: The Pandemic Boom

The COVID-19 pandemic, which began in early 2020, had an unexpected impact on the housing market. Despite economic uncertainty, home prices surged due to historically low mortgage rates, a shift to remote work, and a supply shortage exacerbated by the pandemic. Many people sought more space as they spent more time at home, leading to a spike in demand for single-family homes.

The combination of limited housing inventory and strong demand resulted in bidding wars, pushing home prices to record levels. By mid-2021, home prices were rising at their fastest pace in over 30 years, with some markets experiencing year-over-year increases of more than 20%.

6. 2024 and Beyond: The Future of Home Prices

As we move further into 2024, home prices remain elevated, but the market is beginning too cool. Rising mortgage rates, inflation, and economic uncertainty have slowed demand, though prices in most areas remain high due to ongoing supply shortages. The long-term outlook for home prices will depend on various factors, including changes in interest rates, housing supply, demographic shifts, and the overall health of the economy.

The future may also see a greater reliance on technology in real estate, with virtual tours, AI-driven pricing tools, and more streamlined processes making buying and selling homes more efficient.

The U.S. housing market remains dynamic and continues to evolve, with future developments sure to shape the next chapter in its history. Whether you're a buyer, seller, or investor, understanding these past trends can offer valuable insights into where the market may be headed next.

Categories

Recent Posts